We’ll offer you a couple examples of loans that don’t require bank accounts, in addition to the advantages and dangers of each. Extend your overdraft – This one can be tough, going into your overdraft without permission from your financial institution can even have some extremely high pursuits charges. Central banks, such as the Federal Reserve System banks in the United States and the Bank of England within the United Kingdom, are strong gamers in public finance. When you want greater than $500,000 and have not had luck with banks, try business finance companies. The first thing that you simply want to find out is how many automobile financing options does the financing firm offer. Each lender will offer you an amount they’re prepared to offer you, this may be the quantity you need to buy the automobile and if they are sad with that, they could offer you a decrease amount.

You can use that commerce-in quantity as a down payment that may defray the price of the next automotive’s whole value and lower the month-to-month funds. With month-to-month funds, down payments, upkeep, insurance, taxes, state fees and interest, the overall price of ownership got here to $32,388 for 5 years. Maintenance, insurance, taxes, down funds and month-to-month funds all add to the automobile’s total price, which exceeds the supplier’s asking worth. If the automobile proprietor on this scenario didn’t have Gap insurance coverage, they’d should proceed making payments on a totaled car in order to pay off the outstanding debt. First, it can be used when paying off debt. Extra charges of anyplace from 5 to 20 cents per mile can really add up. Say you drive 3,000 miles more per 12 months than your lease allows, and you’re charged 20 cents per mile. Most three-yr leases permit for 36,000 to 45,000 miles over the life of the lease. But while you add up all of the money you have spent during the last 10 years, you see a transparent advantage of buying a automotive over leasing automobiles. Phillip Reed, a consumer recommendation editor at Edmunds – an auto analyst useful resource – points out that the age-old determination between leasing and buying isn’t actually the difference in finances.

You can use that commerce-in quantity as a down payment that may defray the price of the next automotive’s whole value and lower the month-to-month funds. With month-to-month funds, down payments, upkeep, insurance, taxes, state fees and interest, the overall price of ownership got here to $32,388 for 5 years. Maintenance, insurance, taxes, down funds and month-to-month funds all add to the automobile’s total price, which exceeds the supplier’s asking worth. If the automobile proprietor on this scenario didn’t have Gap insurance coverage, they’d should proceed making payments on a totaled car in order to pay off the outstanding debt. First, it can be used when paying off debt. Extra charges of anyplace from 5 to 20 cents per mile can really add up. Say you drive 3,000 miles more per 12 months than your lease allows, and you’re charged 20 cents per mile. Most three-yr leases permit for 36,000 to 45,000 miles over the life of the lease. But while you add up all of the money you have spent during the last 10 years, you see a transparent advantage of buying a automotive over leasing automobiles. Phillip Reed, a consumer recommendation editor at Edmunds – an auto analyst useful resource – points out that the age-old determination between leasing and buying isn’t actually the difference in finances.

As an illustration, if you’re a latest college grad and are just starting to pay off hefty pupil loans, a very adverse internet value is predicted and does not necessarily replicate badly on your funds. For more info on vehicles, funds and associated matters, go to the next web page.com’s Lease vs. Insurance rates are normally larger for leased vehicles since lease coverage may embrace gap insurance – which pays off what is still owed on the leased vehicle in the occasion the automotive is totalled. The most obvious source of damage comes within the form of financial crises – including the one we’re still recovering from a decade after the actual fact. However it ought to nonetheless be price a portion of its unique worth. As everyone is aware of, a brand new automotive loses value the minute it leaves the lot; in keeping with some estimates, a brand new automotive depreciates by 9 to eleven percent in the primary day.

When a car is driven, بنك الراجحي السعودي it depreciates – reduces in value. What they discovered was that, after a five-yr interval, the actual value of proudly owning a automobile was actually slightly increased than leasing. What is it about leasing a automotive that some find so “unattractive”? You see an ad on television for an amazing automotive you’ve always wanted, and the monthly funds proven are literally inside your financial grasp. After 10 years of proudly owning a automotive, your insurance will decrease, your maintenance prices will improve, and you will have completed off the most important financial burden – the month-to-month cost – years ago. What’s more, maintenance costs are next to nothing, since most warranties for new cars final three years – which is usually around the same amount of time as the average lease period. It’s a staggering amount, however however, consider how much you would have spent leasing vehicles for the same 10-12 months period: Assuming there are no extra charges or penalties, you’ll have coughed up greater than $64,000.

If you liked this post and you would like to obtain extra data relating to الراجحي أون لاين kindly pay a visit to the web site.

A unit of Maybank Group, Etiqa Islamic Berhad affords a variety of general and family Takaful plans across a number of distribution channels in Malaysia, Singapore, the Philippines, Indonesia and Cambodia. Along with mainstream Islamic financing, ADIB Egypt, which has $5.2 billion in belongings, gives investment banking, leasing, asset management and microfinance. Previous researchers have compared the scope, efficiency, and benefit of underwriting completed by business and funding banks. It presents a spread of modern investment solutions across all major asset courses including equities, actual estate, money market, fastened revenue and multi-asset. Malaysia’s Maybank Islamic affords a “halal ecosystem” for small to midsize enterprises (SMEs), delivered by a digital, values-driven platform. It also offers the largest distribution network within the Middle East, ranked by variety of branches, POS, ATMs and remittance centers. With 50 branches, it remains the country’s largest Islamic banking community in addition to its largest by complete property, with a 50% market share in financings and a 40% market share in deposits. Jordan Islamic Bank, which already controls practically half of the kingdom’s Islamic banking market, boasts a rising 9% of Jordan’s complete banking sector belongings.

A unit of Maybank Group, Etiqa Islamic Berhad affords a variety of general and family Takaful plans across a number of distribution channels in Malaysia, Singapore, the Philippines, Indonesia and Cambodia. Along with mainstream Islamic financing, ADIB Egypt, which has $5.2 billion in belongings, gives investment banking, leasing, asset management and microfinance. Previous researchers have compared the scope, efficiency, and benefit of underwriting completed by business and funding banks. It presents a spread of modern investment solutions across all major asset courses including equities, actual estate, money market, fastened revenue and multi-asset. Malaysia’s Maybank Islamic affords a “halal ecosystem” for small to midsize enterprises (SMEs), delivered by a digital, values-driven platform. It also offers the largest distribution network within the Middle East, ranked by variety of branches, POS, ATMs and remittance centers. With 50 branches, it remains the country’s largest Islamic banking community in addition to its largest by complete property, with a 50% market share in financings and a 40% market share in deposits. Jordan Islamic Bank, which already controls practically half of the kingdom’s Islamic banking market, boasts a rising 9% of Jordan’s complete banking sector belongings. Analysts at Ken Research of their latest publication “KSA Auto Finance Market Outlook to 2026F-Driven by Women Entering the Market, Growing Private Entities and Initiatives by the Government” by Ken Research observed the potential of Auto Finance Market Outlook in KSA. Arup’s James Theobalds, transaction director, Meltem Duran, senior offshore wind advisor and Amy Johnstone, renewable vitality consultant, explore the components affecting the outlook for the trade. The automotive business in Thailand is the most important in Southeast Asia and the 10th largest in the world. Ranked amongst the top ten in the banking world inside the United States, PNC Bank has formally joined RippleNet. Innovative banking solutions and investment products that guarantee the success you deserve Welcome to the world of Private Banking, “Al-Khassa” where the eagerness to serve you at all time and to offer you world-class, progressive banking solutions and investment products that guarantee the success you deserve. The same development where put up the pandemic, Vietnamese have been preferring to personal a personal automobile to keep away from public transportation is anticipated to occur. Have you ever ever been to Al Rajhi Bank’s headquarters? People’s experiences with Al Rajhi Gold Bullion mirror the level of confidence and reassurance they really feel when coping with this prestigious financial establishment.

Analysts at Ken Research of their latest publication “KSA Auto Finance Market Outlook to 2026F-Driven by Women Entering the Market, Growing Private Entities and Initiatives by the Government” by Ken Research observed the potential of Auto Finance Market Outlook in KSA. Arup’s James Theobalds, transaction director, Meltem Duran, senior offshore wind advisor and Amy Johnstone, renewable vitality consultant, explore the components affecting the outlook for the trade. The automotive business in Thailand is the most important in Southeast Asia and the 10th largest in the world. Ranked amongst the top ten in the banking world inside the United States, PNC Bank has formally joined RippleNet. Innovative banking solutions and investment products that guarantee the success you deserve Welcome to the world of Private Banking, “Al-Khassa” where the eagerness to serve you at all time and to offer you world-class, progressive banking solutions and investment products that guarantee the success you deserve. The same development where put up the pandemic, Vietnamese have been preferring to personal a personal automobile to keep away from public transportation is anticipated to occur. Have you ever ever been to Al Rajhi Bank’s headquarters? People’s experiences with Al Rajhi Gold Bullion mirror the level of confidence and reassurance they really feel when coping with this prestigious financial establishment. UK Export Finance can now provide monetary assist for overseas initiatives that supply vital minerals to be used in major UK industries. Being a Finance Manager forecasts and manages a cash circulation that meets the needs of the corporate. Maintaining proper money circulation is a brief run goal of financial administration. For example, to hedge out the market-threat of a stock with a market beta of 2.0, an investor would brief $2,000 within the inventory market for each $1,000 invested in the stock. If you would like to face out from the huge competition then you will have to complete any certified programs, because many college students will come out with identical percentage and it will be very laborious to face out. During the real property boom that got here earlier than the housing crash of the late 2000s, lenders bought off large bundles of their loans to buyers, who then traded them as securities similar to stocks. Not solely are you able to deduct money donations to qualified charitable nonprofit organizations (including churches and other religious groups), but you can deduct the money value of bodily donations like clothing, electronics, artwork or actual estate. There are additionally changes to applications, including Social Security and retirement accounts, that took impact at the start of the yr.

UK Export Finance can now provide monetary assist for overseas initiatives that supply vital minerals to be used in major UK industries. Being a Finance Manager forecasts and manages a cash circulation that meets the needs of the corporate. Maintaining proper money circulation is a brief run goal of financial administration. For example, to hedge out the market-threat of a stock with a market beta of 2.0, an investor would brief $2,000 within the inventory market for each $1,000 invested in the stock. If you would like to face out from the huge competition then you will have to complete any certified programs, because many college students will come out with identical percentage and it will be very laborious to face out. During the real property boom that got here earlier than the housing crash of the late 2000s, lenders bought off large bundles of their loans to buyers, who then traded them as securities similar to stocks. Not solely are you able to deduct money donations to qualified charitable nonprofit organizations (including churches and other religious groups), but you can deduct the money value of bodily donations like clothing, electronics, artwork or actual estate. There are additionally changes to applications, including Social Security and retirement accounts, that took impact at the start of the yr. This is true for all property, including automobiles, boats and jewelry. A mark that is both well-designed and true to your values can go a long way in strengthening your unique message. In brief, our lenders gauge what you’ll be able to afford to pay again based in your revenue vs expenditure. The data you present on the W-four determines how much money is withheld from your paycheck every pay interval and paid towards your personal income taxes. Instead of “loaning” the federal authorities an even bigger chunk of their wage and ready for April to get it back, they held on to more of their income to spend and make investments as they happy. Employees who aren’t wasting their time on meaningless chores at work are extra motivated for one. Many individuals purchase life insurance coverage insurance policies to guarantee their households are taken care of financially once they die. From basic car loans and secured loans to chattel mortgages, novated leases or even a business rent purchase.

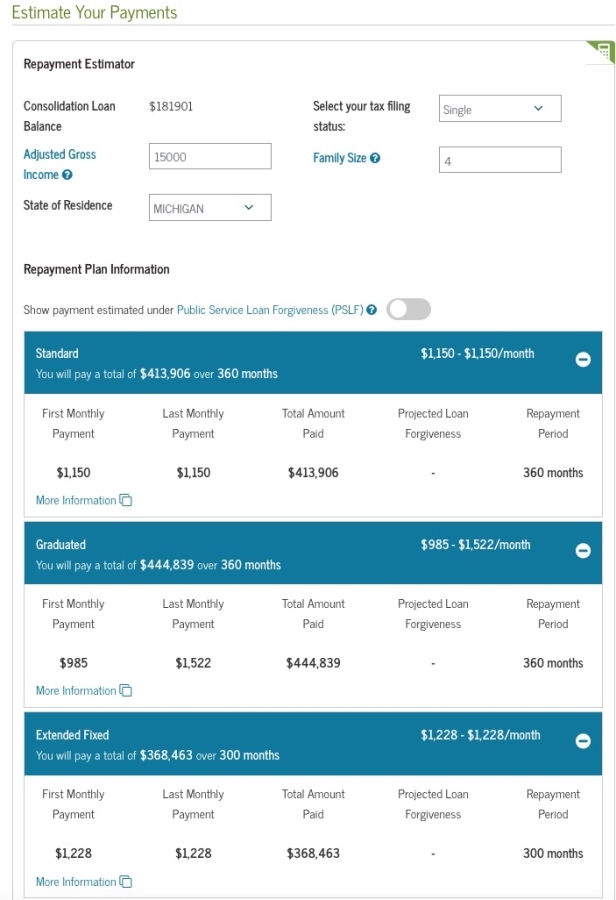

This is true for all property, including automobiles, boats and jewelry. A mark that is both well-designed and true to your values can go a long way in strengthening your unique message. In brief, our lenders gauge what you’ll be able to afford to pay again based in your revenue vs expenditure. The data you present on the W-four determines how much money is withheld from your paycheck every pay interval and paid towards your personal income taxes. Instead of “loaning” the federal authorities an even bigger chunk of their wage and ready for April to get it back, they held on to more of their income to spend and make investments as they happy. Employees who aren’t wasting their time on meaningless chores at work are extra motivated for one. Many individuals purchase life insurance coverage insurance policies to guarantee their households are taken care of financially once they die. From basic car loans and secured loans to chattel mortgages, novated leases or even a business rent purchase. Your present loans may have perks corresponding to curiosity fee reductions, principal reduction discounts, or charge rebates amongst other money-saving benefits. Each time a consumer makes use of an internet payday advance to assist their funds, they are tagged with a payment. This makes the card somewhat unattractive, particularly to those who have to pay the annual price. There are a lot of residents who use various payday loan creditors with a view to disburse off the old. However, in the event that you don’t qualify for the automaker’s mortgage, the dealer may nonetheless give you another loan. This service doesn’t represent an offer or solicitation for mortgage products that are prohibited by any state regulation. A Direct Consolidation Loan allows you to maintain your subsidy benefits on any subsidized loan debts you embody in your consolidation, and borrowers with older (pre-2006), variable-curiosity education loans are eligible for mounted interest rates. You’ll choose a time period size, discover out your curiosity price and sign on the dotted line. M1 Borrow is a portfolio line of credit score that means that you can borrow up to 35% of your portfolio’s worth. We lend up to 70% LVR (mortgage to value ratio) on the price worth. Some citizens might try and break up the associated fee between two further lenders and get charged double value while others struggle to pay it off, paying price again and again once more till the loan is remunerated off.

Your present loans may have perks corresponding to curiosity fee reductions, principal reduction discounts, or charge rebates amongst other money-saving benefits. Each time a consumer makes use of an internet payday advance to assist their funds, they are tagged with a payment. This makes the card somewhat unattractive, particularly to those who have to pay the annual price. There are a lot of residents who use various payday loan creditors with a view to disburse off the old. However, in the event that you don’t qualify for the automaker’s mortgage, the dealer may nonetheless give you another loan. This service doesn’t represent an offer or solicitation for mortgage products that are prohibited by any state regulation. A Direct Consolidation Loan allows you to maintain your subsidy benefits on any subsidized loan debts you embody in your consolidation, and borrowers with older (pre-2006), variable-curiosity education loans are eligible for mounted interest rates. You’ll choose a time period size, discover out your curiosity price and sign on the dotted line. M1 Borrow is a portfolio line of credit score that means that you can borrow up to 35% of your portfolio’s worth. We lend up to 70% LVR (mortgage to value ratio) on the price worth. Some citizens might try and break up the associated fee between two further lenders and get charged double value while others struggle to pay it off, paying price again and again once more till the loan is remunerated off. While non-public student loans cannot be consolidated with federally assured loans in a single Direct Consolidation Loan, there are choices for consolidating your private loans — let’s speak about the professionals and cons. O’Shaughnessy, Lynn. “A brand new technique to shring personal pupil debt.” CBS News Money Watch. What’s the Difference Between Subsidized and Unsubsidized Student Loans? A stone celt or axe was found in a drain at Loans. Interest charges on federally assured education loans and consolidation loans are decided by the federal government, however in the case of non-public loans. The term blended finance implies the mixing of each public and non-public funds via a common investment scheme or deal, with every get together utilizing their experience in a complementary approach. Not all funding services within the financial sector are available to everyone. When Tory chancellor Kenneth Clarke insisted the PFI option had to be explored for every new public venture, it became an additional hurdle to constructing new schools and hospitals, contributing to the precipitous decline in authorities funding below the Tories. Finance and the public Service. We’re an promoting referral service to qualified participating lenders that could be able to offer quantities between $100 and $1,000 for cash advance loans and up to $5,000 for installment loans.

While non-public student loans cannot be consolidated with federally assured loans in a single Direct Consolidation Loan, there are choices for consolidating your private loans — let’s speak about the professionals and cons. O’Shaughnessy, Lynn. “A brand new technique to shring personal pupil debt.” CBS News Money Watch. What’s the Difference Between Subsidized and Unsubsidized Student Loans? A stone celt or axe was found in a drain at Loans. Interest charges on federally assured education loans and consolidation loans are decided by the federal government, however in the case of non-public loans. The term blended finance implies the mixing of each public and non-public funds via a common investment scheme or deal, with every get together utilizing their experience in a complementary approach. Not all funding services within the financial sector are available to everyone. When Tory chancellor Kenneth Clarke insisted the PFI option had to be explored for every new public venture, it became an additional hurdle to constructing new schools and hospitals, contributing to the precipitous decline in authorities funding below the Tories. Finance and the public Service. We’re an promoting referral service to qualified participating lenders that could be able to offer quantities between $100 and $1,000 for cash advance loans and up to $5,000 for installment loans.

While private finance package are great at serving to you manage cash and observe spending, they’re additionally vital for producing experiences. Campaign finance regulation refers to makes an attempt to regulate the ways in which political campaigns are funded. PAIs are essential to understanding the regulation as they characterize a primary SFDR unit. This is the straightforward query at the heart of the advanced Sustainable Finance Disclosure Regulation (SFDR). A Pre-General Report is due 10 days before the overall election or particular election when the candidate’s identify or ballot question appears on the ballot. A Post-General Report is due 30 days after a general or particular election when the candidate’s title or ballot query seems on the ballot. An Initial Report must be filed within 14 days after a candidate or committee raises or spends more than $750. At the end of the 15 days a new cycle would begin. Let’s end by demystifying the SFDR’s timetable. Let’s sort out the basics.

While private finance package are great at serving to you manage cash and observe spending, they’re additionally vital for producing experiences. Campaign finance regulation refers to makes an attempt to regulate the ways in which political campaigns are funded. PAIs are essential to understanding the regulation as they characterize a primary SFDR unit. This is the straightforward query at the heart of the advanced Sustainable Finance Disclosure Regulation (SFDR). A Pre-General Report is due 10 days before the overall election or particular election when the candidate’s identify or ballot question appears on the ballot. A Post-General Report is due 30 days after a general or particular election when the candidate’s title or ballot query seems on the ballot. An Initial Report must be filed within 14 days after a candidate or committee raises or spends more than $750. At the end of the 15 days a new cycle would begin. Let’s end by demystifying the SFDR’s timetable. Let’s sort out the basics.