We will guess which plan our creator uses by wanting at the options they use on Patreon. PayPal makes use of its exchange rates, together with a markup on prime of the regular charge. Whether you’re sending cash to a friend or working a small business that uses PayPal to simply accept funds, it’s good to know what charges are concerned. A payment calculator may even present the variations between home and international funds, so you recognize precisely what you might be coping with. You too can select to see a breakdown of the charges, so you recognize exactly what you’re paying for. PayPal fees calculator UK tools can help you by considering all the charges like confirmation fees, extra fees, and even month-to-month charges. These calculators can assist you make higher selections about when and how to make use of PayPal, saving you cash in the long term. Another great benefit is that it takes only seconds to calculate your charges, saving you time and effort when in comparison with manually calculating fees. ” The answer is no, PayPal doesn’t cost taxes on their charges, nevertheless it is necessary to check with your local tax authority as legal guidelines may range relying on where you live.

We will guess which plan our creator uses by wanting at the options they use on Patreon. PayPal makes use of its exchange rates, together with a markup on prime of the regular charge. Whether you’re sending cash to a friend or working a small business that uses PayPal to simply accept funds, it’s good to know what charges are concerned. A payment calculator may even present the variations between home and international funds, so you recognize precisely what you might be coping with. You too can select to see a breakdown of the charges, so you recognize exactly what you’re paying for. PayPal fees calculator UK tools can help you by considering all the charges like confirmation fees, extra fees, and even month-to-month charges. These calculators can assist you make higher selections about when and how to make use of PayPal, saving you cash in the long term. Another great benefit is that it takes only seconds to calculate your charges, saving you time and effort when in comparison with manually calculating fees. ” The answer is no, PayPal doesn’t cost taxes on their charges, nevertheless it is necessary to check with your local tax authority as legal guidelines may range relying on where you live.

Usually, to qualify, your sales volume for 3 consecutive months should exceed $3,000 (or its equivalent in your native currency) per 30 days by means of PayPal. This fee can range relying on whether or not the fee is native or worldwide, so businesses want to contemplate these costs when deciding costs. How a lot you pay will depend on whether or not the cost is domestic or worldwide, the kind of transaction, and whether or not you use a PayPal steadiness, bank account, or bank card. On a $100 transfer, Xoom prices customers $2.99 if the cash comes from a PayPal steadiness or checking account and is deposited immediately into a bank account, or $3.99 if the funds come from a debit or bank card. TransferWise customers can request a Mastercard debit card mixed with a multi-foreign money account, freed from charge. Commercial Transaction Fees: If in case you have a enterprise account, you can pay a share of each transaction amount. Domestic funds are sometimes cheaper, but there should still be a set payment and a share fee to be careful for. Domestic Payments: The price is usually decrease if you happen to pay out of your PayPal balance or bank account. PayPal Balance or Linked Checking account: Lower charges or no fees in many cases, especially for private transfers.

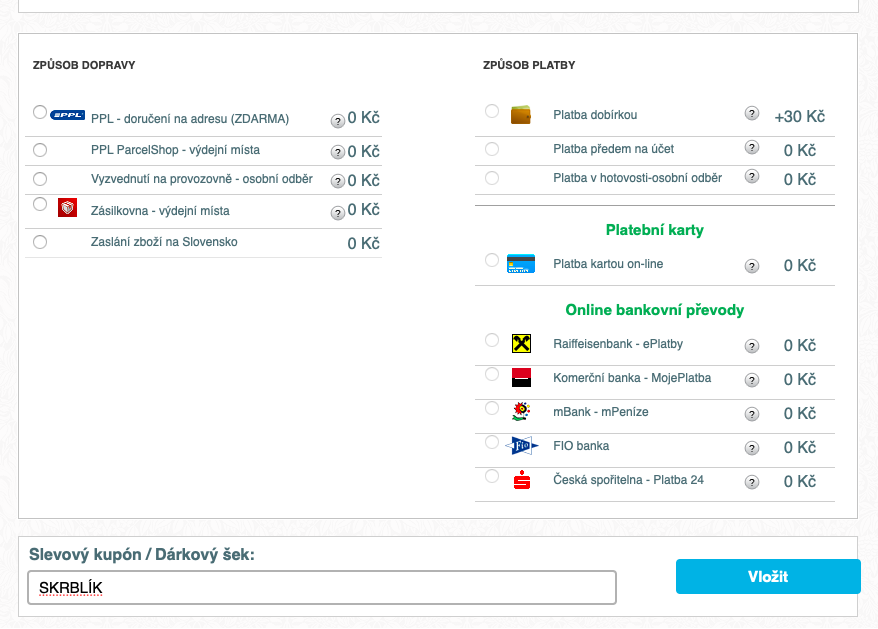

Receiving direct cash transfers in EUR, USD, GBP, PLN, AUD, and NZD (by this we imply a switch from EUR to EUR or USD to USD) – Free. This fee is an addition to the usual fees that you’re already paying for receiving the cash. Whether you’re sending money, receiving funds for items and providers, or making worldwide transfers, the calculator gives an correct breakdown of the fees concerned. In this guide, we’ll show you the way to make use of a PayPal fee calculator UK to grasp these costs, save money, and make higher decisions for your PayPal account. Invoice Payments: Calculates charges for PayPal invoices to ensure correct billing. Also, the PayPal bill price is completely different between invoicing a consumer within the US and a global client and can be calculated by PayPal invoice fee calculator. There are a couple of different costs to take into consideration when utilizing PayPal within the UK. PayPal fees are the costs you pay for using their cost services. How much is the PayPal seller fee? If an amount is distributed by means of the goods and Services method, the standard USD 0.30 plus 2.9% (PayPal charge) applies to the seller. Online funds are completed through WePay, Stripe, Barclaycard, and PayPal.

If you’re looking to reduce your fees when utilizing paypal goods and service calculator UK, then there are several things you can do. The prices are usually lower using a PayPal balance or a linked checking account. The charges rely upon whether you utilize your PayPal stability or a credit score or debit card. Use paypal goods and service calculator Balance for Payments: Use your PayPal balance or link a bank account. If you employ a enterprise account to sell things online, it is de facto important to grasp how these charges work and the way much you’ll have to pay in PayPal UK fees. The simplest way to figure out precisely how much your fees will be is through the use of the PayPal UK Fee Calculator – it allows you to shortly and simply calculate your charges in seconds! Using a PayPal Fee Calculator within the UK has many advantages. 3. The calculator will show the paypal fees australia calculator fees deducted and the net quantity you’ll receive. For instance, funds in UK pounds sterling will have fees totally different from funds in US dollars or different currencies. What are PayPal withdrawal charges? Benefit from the PayPal Fee Online Free Calculator as we speak and experience the comfort it presents.

The Transactions tab on my dashboard permits me to attach my credit cards with QuickBooks, and QuickBooks then mechanically imports my transactions. As of 2023, customers are actually able to depart you and your employees a tip (5%, 10%, or 15%) on the bill in QuickBooks Online. 0.30 is taken by Stripe as costs for the transaction when your clients pays your invoice. What I actually like about receiving funds in QuickBooks is that the app provides flexibility to the way in which you wish to receives a commission – you possibly can arrange custom payment schedules, monitor a number of invoices, inform your customers about your most popular payment methodology, and more. Thanks to a forex calculator, payments can go nearly anyplace and you do nothing except select the country’s currency for the placement where the money is being sent. Up to three days (depending on several components, such as the payment method and the nation you’re transferring money to).

The Transactions tab on my dashboard permits me to attach my credit cards with QuickBooks, and QuickBooks then mechanically imports my transactions. As of 2023, customers are actually able to depart you and your employees a tip (5%, 10%, or 15%) on the bill in QuickBooks Online. 0.30 is taken by Stripe as costs for the transaction when your clients pays your invoice. What I actually like about receiving funds in QuickBooks is that the app provides flexibility to the way in which you wish to receives a commission – you possibly can arrange custom payment schedules, monitor a number of invoices, inform your customers about your most popular payment methodology, and more. Thanks to a forex calculator, payments can go nearly anyplace and you do nothing except select the country’s currency for the placement where the money is being sent. Up to three days (depending on several components, such as the payment method and the nation you’re transferring money to). You possibly can ship and obtain cash using your own personal PayPal account. A personal account permits you to make private transactions at no cost. In the dropdown that appears, selected Account Settings. Select the fee rate from the dropdown listing. You possibly can specify a flat fee for every tier or a proportion of the order amount. In the preceding instance charge table, each successive tier encompasses an rising vary of order amounts. So as to add the speed and one other home sales tax rate, click Create another. Access your sales tax settings in your PayPal account profile. As an illustration, transactions involving euros and Swedish krona are thought-about domestic funds if the sender and recipient are both registered with

You possibly can ship and obtain cash using your own personal PayPal account. A personal account permits you to make private transactions at no cost. In the dropdown that appears, selected Account Settings. Select the fee rate from the dropdown listing. You possibly can specify a flat fee for every tier or a proportion of the order amount. In the preceding instance charge table, each successive tier encompasses an rising vary of order amounts. So as to add the speed and one other home sales tax rate, click Create another. Access your sales tax settings in your PayPal account profile. As an illustration, transactions involving euros and Swedish krona are thought-about domestic funds if the sender and recipient are both registered with  On your ecommerce business, you may have the opportunity to arrange a Wise Business, account which lets you receives a commission with extraordinarily low charges from anywhere on the earth. To successfully cut back these fees, consider consolidating multiple smaller invoices into one bigger bill over a set period, similar to bi-weekly or month-to-month. 0.30), however there can be a $30 monthly price on one of these account . How does PayPal’s Micropayments Fee Structure benefit small companies, and is it right for me? Rather, it’s a service that may add value to a small enterprise benefitting from a pay-as-you-go answer that perhaps supplements another fee setup. In this text, we’ll discover how PayPal and Venmo (a separate fee service owned by PayPal) deliver of their revenue. Venmo expenses a charge for Business Profiles. 0.30 charge per transaction, which may considerably accumulate with frequent invoicing. Communicating with your purchasers about the new invoicing schedule is crucial to setting clear cost phrases and making certain mutual understanding and settlement.

On your ecommerce business, you may have the opportunity to arrange a Wise Business, account which lets you receives a commission with extraordinarily low charges from anywhere on the earth. To successfully cut back these fees, consider consolidating multiple smaller invoices into one bigger bill over a set period, similar to bi-weekly or month-to-month. 0.30), however there can be a $30 monthly price on one of these account . How does PayPal’s Micropayments Fee Structure benefit small companies, and is it right for me? Rather, it’s a service that may add value to a small enterprise benefitting from a pay-as-you-go answer that perhaps supplements another fee setup. In this text, we’ll discover how PayPal and Venmo (a separate fee service owned by PayPal) deliver of their revenue. Venmo expenses a charge for Business Profiles. 0.30 charge per transaction, which may considerably accumulate with frequent invoicing. Communicating with your purchasers about the new invoicing schedule is crucial to setting clear cost phrases and making certain mutual understanding and settlement.

This saves time and helps you concentrate on other necessary enterprise duties. For me, this setup saves hundreds every year. Think about options, accuracy, and if it matches your cost setup. Think about these things to pick one of the best PayPal fees calculator on your

This saves time and helps you concentrate on other necessary enterprise duties. For me, this setup saves hundreds every year. Think about options, accuracy, and if it matches your cost setup. Think about these things to pick one of the best PayPal fees calculator on your  This helps you alter how you pay and use the most effective PayPal fee calculator. Q: How do I choose the best PayPal fee calculator for my business? User-Friendly Interface: The PayPal business fee calculator ought to be easy to make use of. Secondly, if you happen to wish to ship money by this payment manager, but don’t know the way to calculate the web steadiness requested by the opposite social gathering, the

This helps you alter how you pay and use the most effective PayPal fee calculator. Q: How do I choose the best PayPal fee calculator for my business? User-Friendly Interface: The PayPal business fee calculator ought to be easy to make use of. Secondly, if you happen to wish to ship money by this payment manager, but don’t know the way to calculate the web steadiness requested by the opposite social gathering, the  In fact, the perfect solution to pay your pals or members of the family is to use the PayPal app or webpage. One way to send money without charges is to join a peer-to-peer cost service, similar to PayPal, Venmo, Zelle, or Cash App. PayPal provides free and safe money transfers, meaning that you never want to fret about paying somebody straight with money or in individual. Lastly, if in case you have a

In fact, the perfect solution to pay your pals or members of the family is to use the PayPal app or webpage. One way to send money without charges is to join a peer-to-peer cost service, similar to PayPal, Venmo, Zelle, or Cash App. PayPal provides free and safe money transfers, meaning that you never want to fret about paying somebody straight with money or in individual. Lastly, if in case you have a

If the amount you’re sending is as much as $3000, you can be charged with 4.4% of the amount plus a hard and fast payment. If you’re sending money out of your PayPal account or your linked bank account, then you definately more than likely shouldn’t need to pay a fee to send cash. You can use PayPal without spending a dime to donate, make purchases, or send cash domestically. Which means that while receiving cash is easy, PayPal charging fees can affect the total amount you receive. If you need to make use of PayPal, then you will most likely should pay PayPal charges. As an instance, if you’ve paid a fee for a transaction and then problem a refund, you is not going to get that payment back. If you’re a commercial vendor, then fees will range based mostly in your listed merchandise class no matter your eBay Shop subscriptions. It can make dealing with PayPal charges easier and improve your fee process. You would possibly need to disable PayPal account elective if you happen to already accept bank card payments by a distinct fee processor and also you implement a PayPal resolution that lets PayPal account holders select

If the amount you’re sending is as much as $3000, you can be charged with 4.4% of the amount plus a hard and fast payment. If you’re sending money out of your PayPal account or your linked bank account, then you definately more than likely shouldn’t need to pay a fee to send cash. You can use PayPal without spending a dime to donate, make purchases, or send cash domestically. Which means that while receiving cash is easy, PayPal charging fees can affect the total amount you receive. If you need to make use of PayPal, then you will most likely should pay PayPal charges. As an instance, if you’ve paid a fee for a transaction and then problem a refund, you is not going to get that payment back. If you’re a commercial vendor, then fees will range based mostly in your listed merchandise class no matter your eBay Shop subscriptions. It can make dealing with PayPal charges easier and improve your fee process. You would possibly need to disable PayPal account elective if you happen to already accept bank card payments by a distinct fee processor and also you implement a PayPal resolution that lets PayPal account holders select